Disclosure: This post contains affiliate links. If you purchase through these links, we may earn a commission at no extra cost to you.

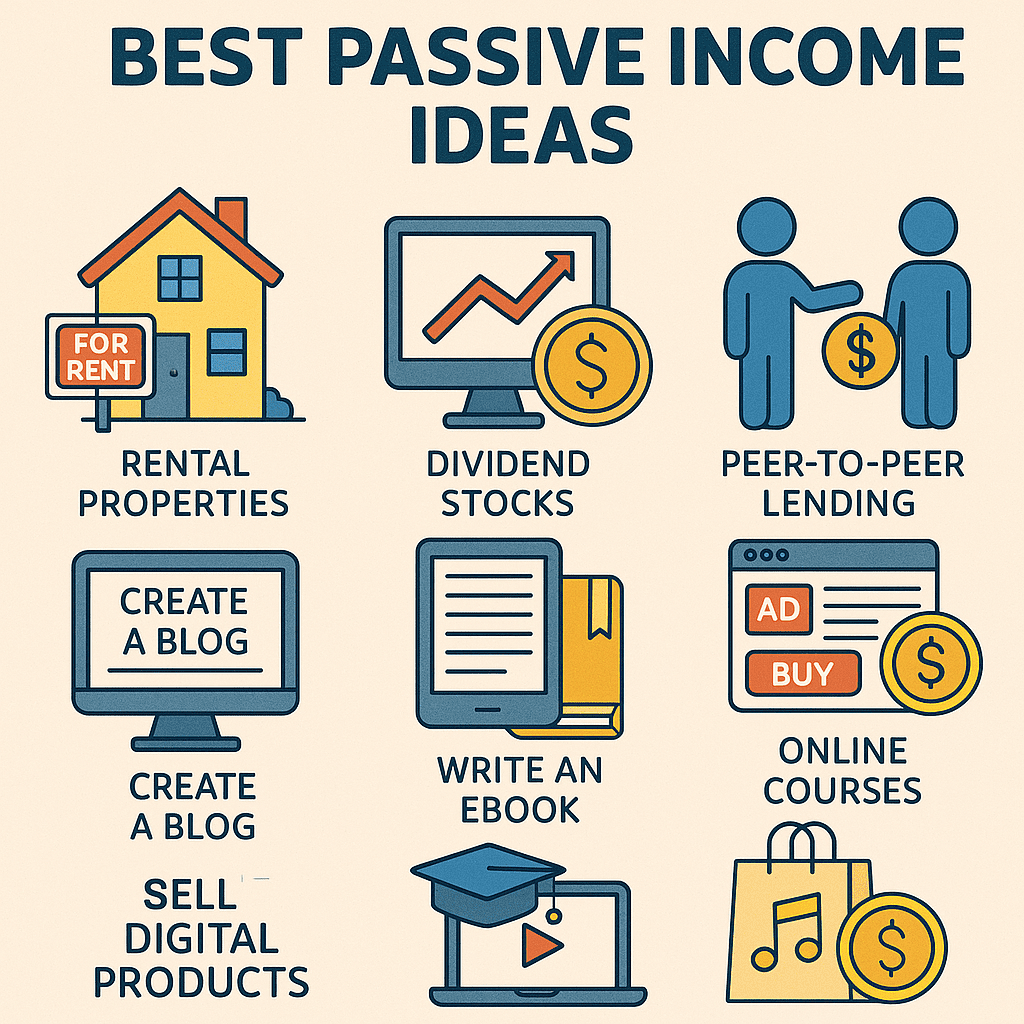

Looking for the best passive income ideas that work in today's economy? You're not alone. With rising living costs and economic uncertainty, building automated revenue streams has become essential for financial freedom. Passive income isn't about getting rich quick—it's about creating systems that generate money while you sleep, travel, or focus on other priorities. In this guide, we'll explore 45 proven passive income strategies, dive deep into the most effective ones, and show you how to start earning with minimal ongoing effort.

Real Estate Passive Income Streams

Real estate remains one of the most reliable ways to build wealth passively. Here are three top approaches:

1. Rental Properties

Long-term rentals provide steady monthly cash flow after initial setup. While not entirely “hands-off,” property managers can handle operations. Key benefits include:

- Appreciation potential over time

- Tax deductions for expenses

- Inflation hedge through rent increases

Start small with a single-family home or explore duplexes for higher yields.

2. Real Estate Investment Trusts (REITs)

For those wanting real estate exposure without physical properties, REITs are perfect. These publicly traded companies own income-generating real estate. Advantages include:

- Liquidity (trade like stocks)

- Low minimum investments

- Professional management

Look for REITs specializing in commercial, residential, or niche markets like data centers.

3. Real Estate Crowdfunding

Platforms like Fundrise or Crowdstreet let you pool money with other investors. This model offers:

- Access to larger properties

- Lower capital requirements

- Geographic diversification

Minimum investments start at $500, making it accessible for beginners.

Digital Product Passive Income Models

The digital economy offers incredible scalability. Create once, sell infinitely:

4. Online Courses

Package your expertise into video courses. Platforms like Teachable handle payments and hosting. Success factors:

- Solve specific problems

- Include downloadable resources

- Offer community access

Evergreen topics like personal finance, coding, or wellness sell consistently.

5. Ebooks and Digital Guides

Write once, earn forever through Amazon KDP or Gumroad. Best practices:

- Target niche audiences

- Use professional formatting

- Implement email marketing funnels

Non-fiction guides outperform fiction for passive income potential.

6. Stock Media Assets

Photographers, videographers, and musicians can earn royalties through:

- Stock photo sites (Shutterstock, Adobe Stock)

- Music platforms (AudioJungle, Pond5)

- Template marketplaces (Envato)

Focus on high-demand niches like business, technology, or lifestyle content.

Investment-Based Passive Income

Let your money work for you through these time-tested strategies:

7. Dividend Investing

Build a portfolio of dividend-paying stocks or ETFs. Key considerations:

- Focus on companies with consistent payout histories

- Reinvest dividends for compound growth

- Diversify across sectors

S&P 500 dividend aristocrats have increased payouts for 25+ consecutive years.

8. Peer-to-Peer Lending

Platforms like Prosper or LendingClub connect investors with borrowers. Features:

- Higher yields than savings accounts

- Customizable risk levels

- Monthly cash flow

Start with small notes across multiple loans to mitigate default risk.

9. High-Yield Savings Accounts

The simplest passive income with zero risk. Current benefits:

- FDIC insurance up to $250,000

- Liquidity for emergencies

- Competitive rates (4-5% APY in 2024)

Online banks typically offer better rates than traditional institutions.

How to Start Your Passive Income Journey

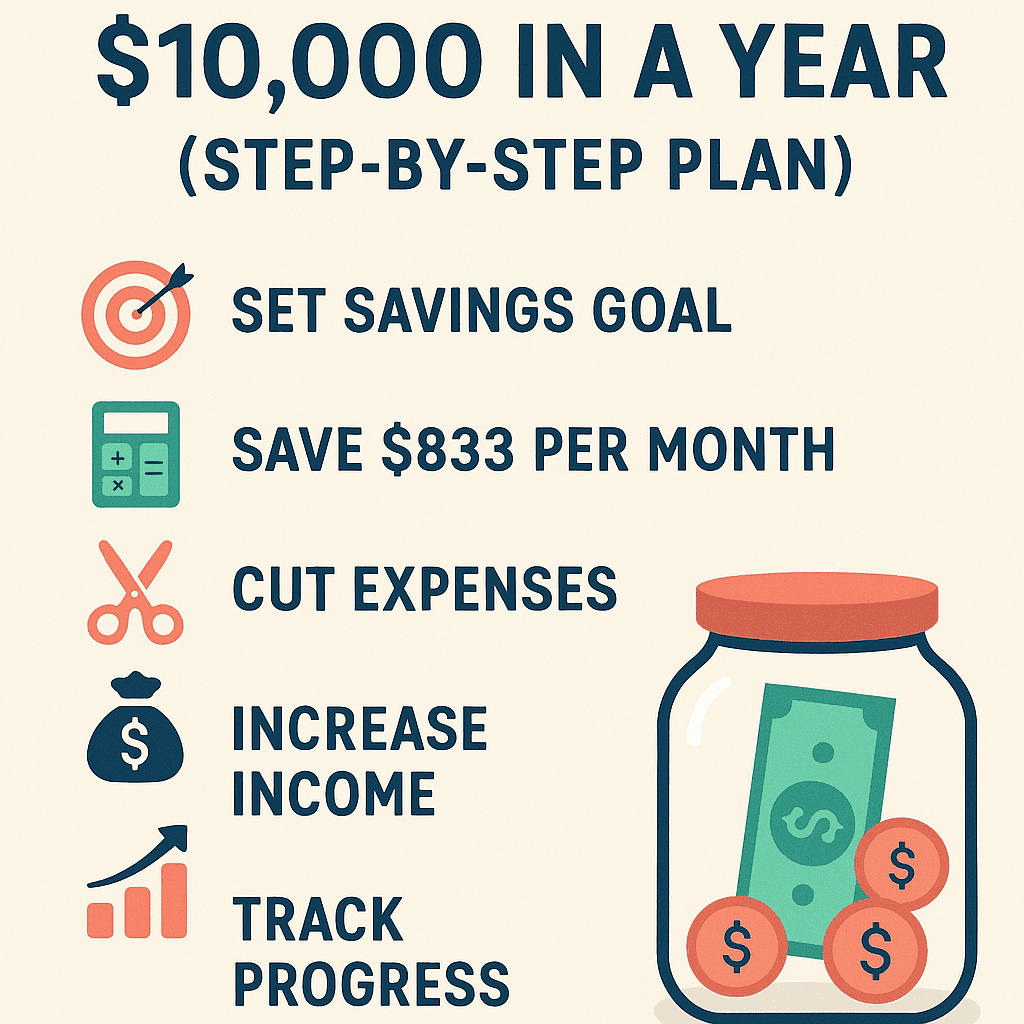

Ready to take action? Follow these steps to begin earning passively:

- Assess Your Resources: Determine available capital, time, and skills

- Choose Your Model: Select 1-2 ideas that align with your strengths

- Start Small: Test with minimal investment before scaling

- Automate Systems: Use tools to minimize ongoing effort

For a complete blueprint covering all 45 passive income strategies with step-by-step implementation guides, check out this comprehensive passive income course. It includes exclusive templates, resource lists, and community support to accelerate your success.

Frequently Asked Questions

What's the fastest way to start earning passive income?

High-yield savings accounts and dividend ETFs offer the quickest setup—often within days. For digital products, stock media assets can generate income within weeks if you have existing content.

How much money do I need to start?

Some ideas require $0 (like creating digital products with free tools), while others like real estate crowdfunding start at $500. Many investment options have minimums under $100.

Is passive income really “passive”?

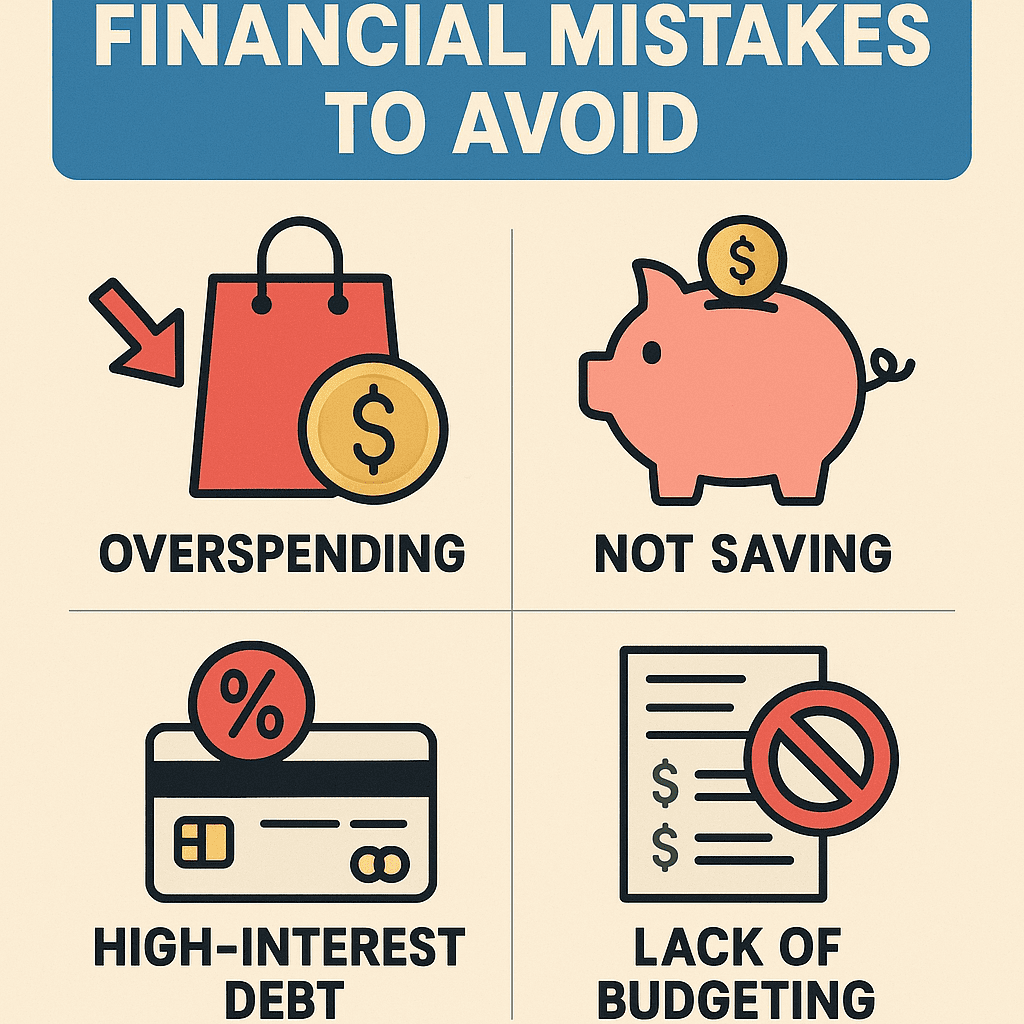

Most passive income streams require significant upfront work or capital. The “passive” aspect comes from minimal ongoing maintenance after the initial setup. True 100% passive income is rare but achievable with proper systems.

Which passive income idea has the highest returns?

Successful online courses and rental properties often yield 20-50% annual returns, but they carry higher risk and effort. Dividend investing typically offers 4-8% with lower volatility.

How long does it take to see results?

Investment-based income may start within months, while digital products and real estate often take 6-12 months to build momentum. Consistency and patience are key to long-term success.

Conclusion

Building passive income that works requires strategic planning and initial effort, but the financial freedom it provides is invaluable. Whether you choose real estate, digital products, or investments, start today—even small steps compound over time. Remember, the best passive income idea is the one you actually implement consistently. Ready to transform your financial future? Get instant access to the complete 45 passive income strategies blueprint here and start building your automated revenue streams this week!