This post may contain affiliate links, which means we may earn a commission if you make a purchase through our links, at no extra cost to you.

How Inflation Affects Your Savings & Investments: What You Need to Know

Inflation isn't just economic jargon – it's the silent thief quietly stealing your purchasing power. Understanding how inflation affects your savings & investments is crucial for protecting your financial future. When prices rise across the economy, every dollar you've saved or invested buys less than it did before. This comprehensive guide breaks down inflation's impact and gives you actionable strategies to safeguard your wealth.

What Exactly is Inflation Doing to Your Money?

Imagine your savings account as a bucket with a slow leak. That leak is inflation. At just 3% annual inflation, $100 today will only buy about $74 worth of goods in 10 years. This erosion happens silently but relentlessly, affecting both your cash savings and investment returns.

The Hidden Tax on Your Savings

Traditional savings accounts feel safe, but they're actually losing ground during inflationary periods:

- The average savings account yields 0.5% APY while inflation hovers around 3-4%

- Your money loses 2.5-3.5% of purchasing power annually after accounting for taxes

- $10,000 in savings loses $250-$350 in real value every year

How Different Investments React to Inflation

Not all investments suffer equally during inflation. Understanding these differences is key to building a resilient portfolio:

Stocks: The Double-Edged Sword

Stocks can be both inflation victims and inflation fighters:

- Growth stocks often struggle as rising interest rates increase borrowing costs

- Value stocks (especially in energy, materials, and consumer staples) typically outperform

- Companies with pricing power can pass costs to consumers, protecting margins

Bonds: The Inflation Casualty

Fixed-income investments take a direct hit during inflation:

- Existing bonds lose value as new bonds offer higher yields

- Long-term bonds suffer more than short-term bonds

- TIPS (Treasury Inflation-Protected Securities) are the exception, adjusting principal with inflation

Real Assets: Your Inflation Shield

Certain investments historically perform well when prices rise:

Real Estate: Tangible Inflation Hedge

Property values and rents typically rise with inflation:

- Residential real estate has averaged 4.1% annual appreciation since 1968

- Commercial leases often include inflation adjustment clauses

- REITs offer accessible real estate exposure with liquidity

Commodities: Direct Inflation Play

Raw materials become more valuable as production costs rise:

- Gold has preserved purchasing power for centuries

- Oil and industrial metals benefit from supply constraints

- Agricultural commodities rise with food price inflation

Building Your Inflation-Resistant Portfolio

Protecting your wealth requires strategic diversification. Consider this asset allocation approach:

- Pricing power & dividends

| Asset Class | Inflation Protection | Recommended Allocation |

|---|---|---|

| TIPS/I-Bonds | Direct inflation adjustment | 15-20% |

| Commodities | Price appreciation | 5-10% |

| Real Estate/REITs | Rental income & appreciation | 15-25% |

| Value Stocks | 30-40% | |

| Cash Equivalents | Liquidity needs only | 5-10% |

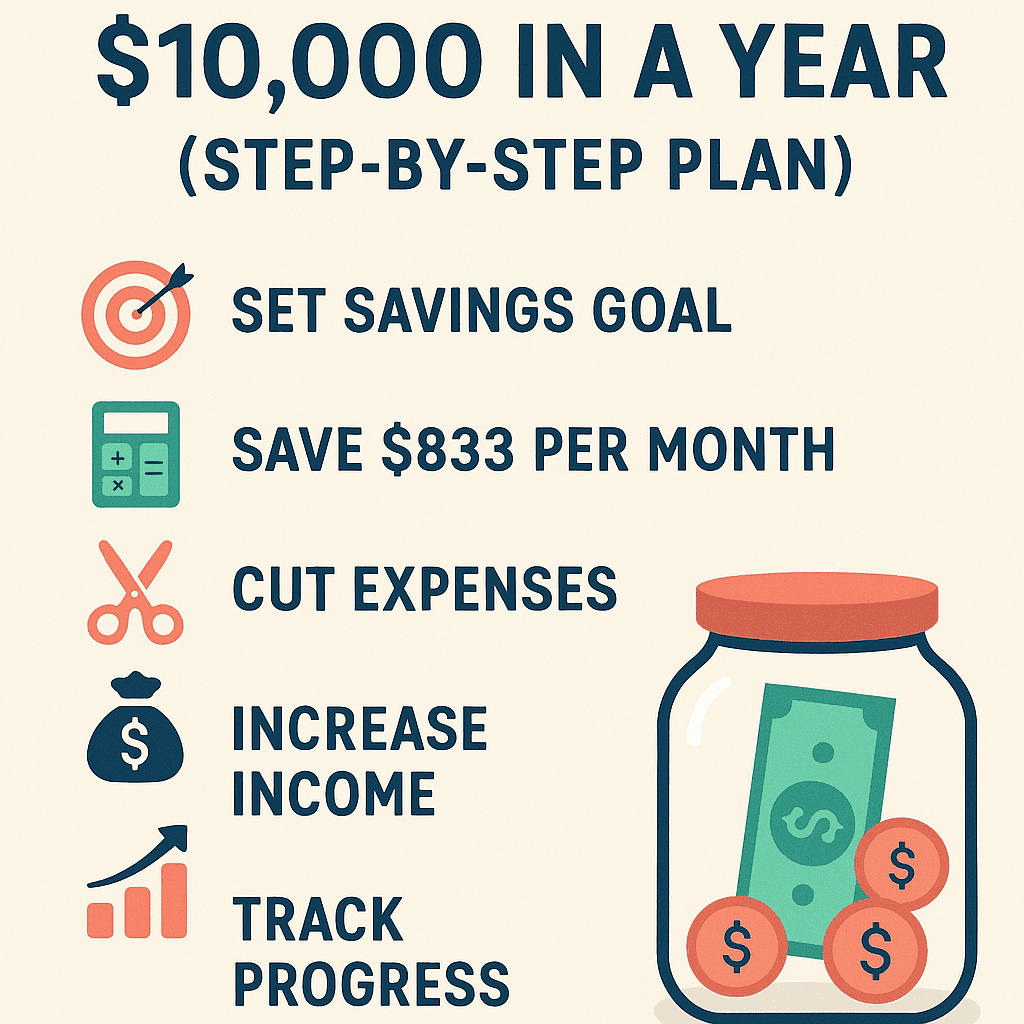

Practical Steps to Protect Your Wealth Today

Implement these strategies immediately to combat inflation:

- Review your savings allocation: Keep only 3-6 months of expenses in cash

- Ladder your bonds: Create a bond ladder to reinvest at higher rates

- Add inflation fighters: Allocate 10-15% to TIPS and commodities

- Focus on dividends: Choose stocks with consistent dividend growth

- Consider real assets: Explore REITs or physical property investments

Frequently Asked Questions

Q: How often should I adjust my portfolio for inflation?

A: Review your allocation annually or whenever inflation exceeds 4% for two consecutive quarters. Rebalance when any asset class deviates more than 5% from your target.

Q: Are cryptocurrencies good inflation hedges?

A: While some view Bitcoin as “digital gold,” crypto remains highly volatile. Consider limiting exposure to 1-3% of your portfolio and treating it as a speculative hedge rather than core protection.

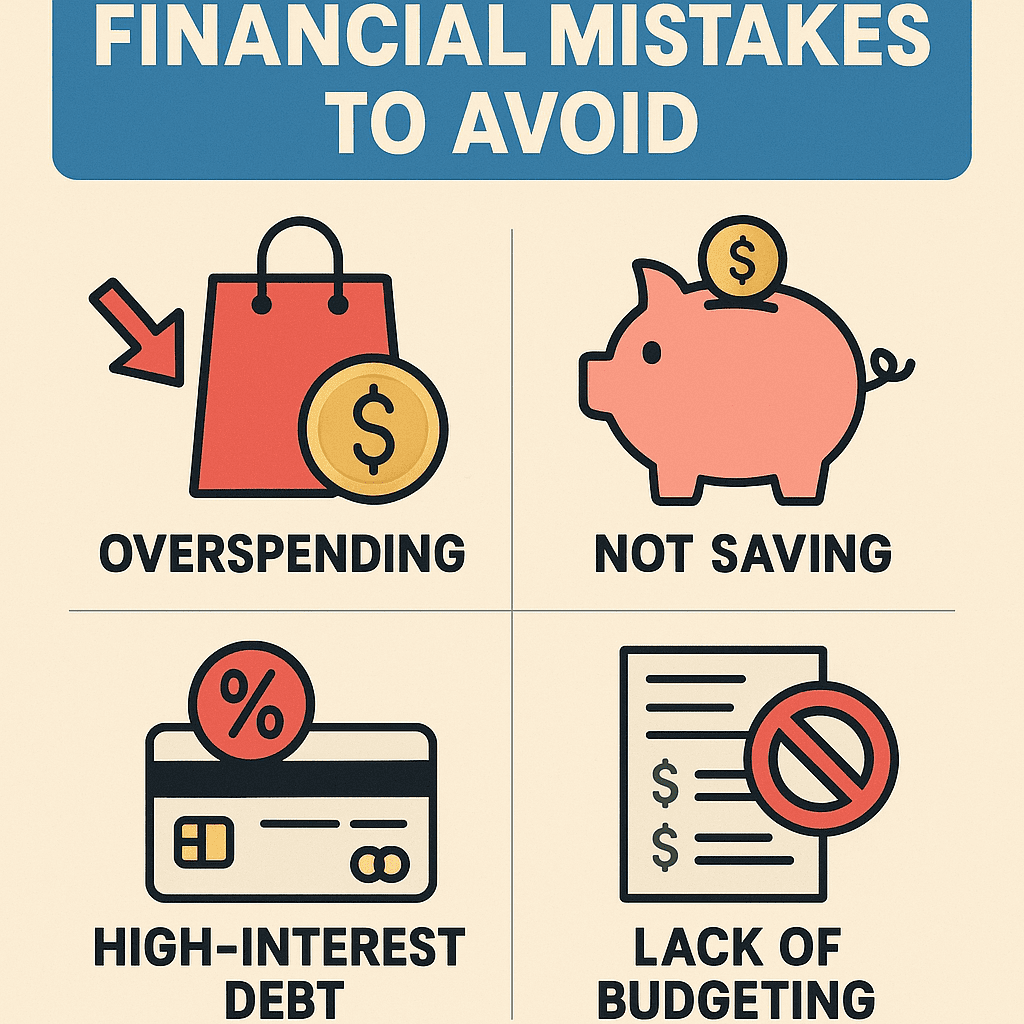

Q: Should I pay off debt during high inflation?

A: Prioritize high-interest debt (credit cards, personal loans). Fixed-rate mortgages can actually benefit you as inflation erodes the real value of your debt.

Q: How does inflation impact retirement planning?

A: Inflation significantly reduces retirement purchasing power. Plan for 3-4% annual inflation in your projections and ensure your portfolio generates growing income streams.

Conclusion: Take Control of Your Financial Future

Understanding how inflation affects your savings & investments is the first step toward protecting your wealth. By diversifying into inflation-resistant assets and maintaining strategic allocations, you can turn this economic challenge into an opportunity. Don't let inflation silently erode your hard-earned money – start implementing these protective strategies today.

Ready to build an inflation-proof portfolio? Discover our recommended investment tools and resources to get started on securing your financial future against rising prices.