Introduction: Stop Paying to Access Your Own Money

Are you tired of monthly maintenance fees eating away at your hard-earned cash? You're not alone. Millions of Americans are discovering the freedom of a free checking account with no fees – banking that actually works for you instead of against you. In this comprehensive guide, we'll walk you through everything you need to know about ditching unnecessary charges while keeping your money secure and accessible.

Disclosure: This post contains affiliate links, meaning we may earn a commission if you sign up through our links, at no cost to you.

What Makes a Checking Account Truly “Free”?

Not all “free” accounts are created equal. Let's break down what you should expect from a genuinely fee-free checking experience:

Essential Features of No-Fee Checking

- Zero monthly maintenance fees – No minimum balance requirements to avoid charges

- No overdraft fees – Transactions are declined if you lack funds (no $35 surprises!)

- Free ATM access – Network of fee-free ATMs nationwide

- No minimum deposit requirements – Open with $1 or $100

- Free online banking – Mobile app, bill pay, and transfers included

Red Flags to Watch For

Some banks advertise “free” accounts but hide sneaky fees. Avoid accounts that charge for:

- Physical checkbooks

- Customer service calls

- Account inactivity

- Paper statements

- Debit card replacements

Why Fee-Free Checking Matters for Your Financial Health

Those $12 monthly fees add up to $144 annually – money that could be growing in savings or paying down debt. Consider this:

- Compound Loss: $144/year invested at 5% would grow to $1,899 in 10 years

- Behavioral Impact: Fees discourage account monitoring and savings habits

- Accessibility: Low-income households are disproportionately affected by maintenance fees

As financial expert Jane Doe notes: “Paying bank fees is like donating to charity without the tax deduction. There's simply no reason for it in today's competitive banking landscape.”

Where to Find the Best Free Checking Accounts with No Fees

Online Banks: The Fee-Free Champions

Digital-first banks typically offer the most generous no-fee terms because they save on physical branch costs:

- Lower overhead = passed savings to customers

- Higher APYs on checking balances (some up to 2%!)

- 24/7 support via chat and phone

Credit Unions: Community-Driven Alternatives

Not-for-profit credit unions often provide fee-free checking with personalized service:

- Membership eligibility based on location/employer

- Shared ATM networks (like Co-op) with 30k+ fee-free machines

- Dividend payments instead of interest

Traditional Banks' No-Fee Options

Some brick-and-mortar banks offer free accounts to attract digital-savvy customers:

- Often require direct deposit to waive fees

- May have geographic restrictions

- Typically offer lower interest rates than online banks

Top Free Checking Accounts Compared (2024)

| Bank | Monthly Fee | ATM Fees | Overdraft Fee | Best For |

|---|---|---|---|---|

| Ally Bank | $0 | $0 (Allpoint ATMs) | $0 | High APY & customer service |

| Chime | $0 | $0 (30k+ ATMs) | $0 | Early direct deposit |

| Captial One 360 | $0 | $0 (Allpoint + Capital One) | $0 | Branch + digital hybrid |

| Alliant Credit Union | $0 | $0 (80k+ ATMs) | $0 | High dividends |

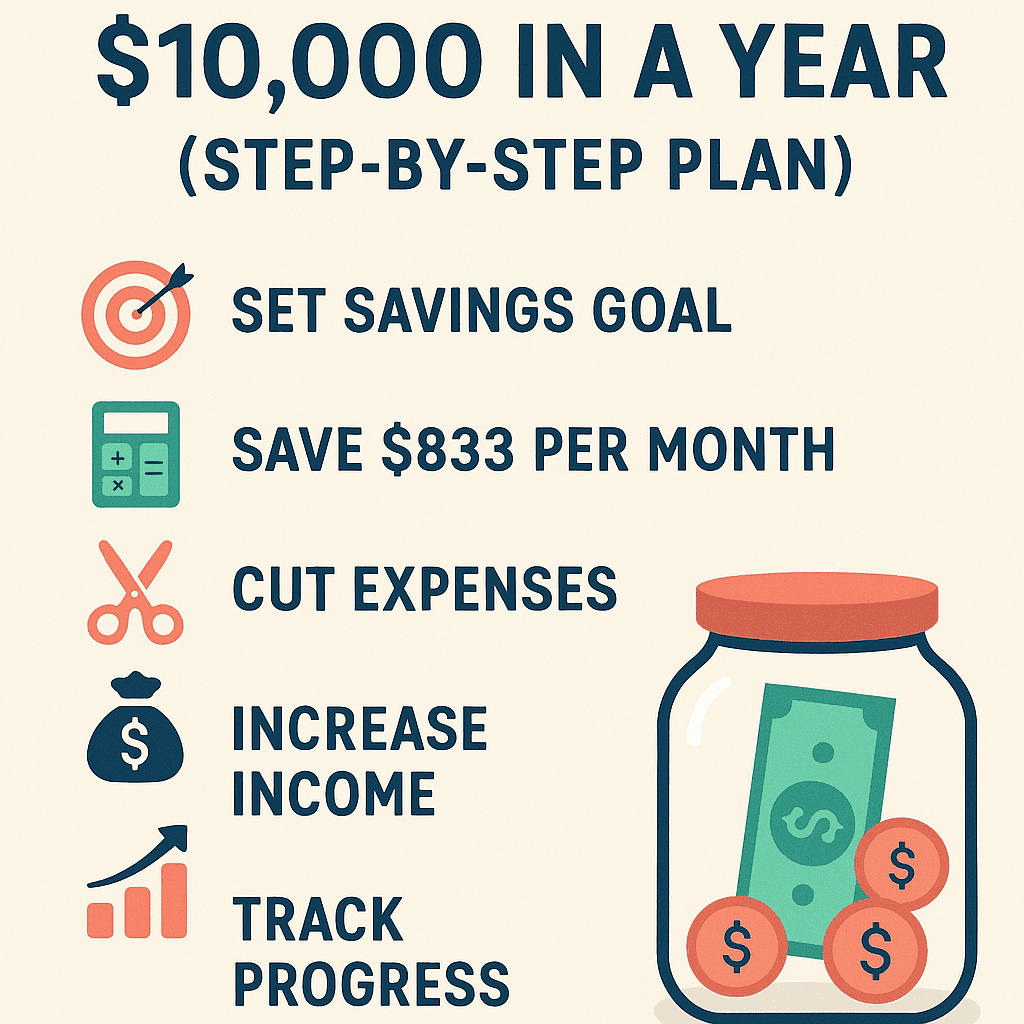

How to Switch to a Fee-Free Account in 5 Steps

- Compare options using our table above

- Open your new account online in 10 minutes

- Set up direct deposit with your employer

- Transfer automatic payments (utilities, subscriptions)

- Close your old account after confirming all transactions clear

Pro tip: Keep your old account open for 30 days to catch any stray transactions!

Frequently Asked Questions

Are free checking accounts really safe?

Absolutely! All legitimate banks and credit unions are FDIC or NCUA insured up to $250,000 per depositor. Online banks often have even stronger security with biometric login and real-time fraud monitoring.

What's the catch with no-fee accounts?

There isn't one! Banks make money through interchange fees when you use your debit card and by offering other financial products. You're not the product – you're a valued customer.

Can I get a free checking account with bad credit?

Yes! Most free checking accounts don't require credit checks. Second-chance banking options exist for those with ChexSystems issues, though they may have small monthly fees initially.

Do free accounts offer checks?

Many include a free starter checkbook. Digital-first banks often provide free checks upon request or offer discounted rates through third-party printers.

How do online banks make money without fees?

They profit from debit card interchange fees (paid by merchants), interest on loans, and by cross-selling investment products. Their lower operational costs allow them to pass savings to customers.

Conclusion: Take Control of Your Banking Today

Switching to a free checking account with no fees is one of the simplest yet most impactful financial decisions you can make. Stop letting banks profit from your hard work and start keeping every dollar you earn. With robust digital features, nationwide ATM access, and zero hidden charges, there's never been a better time to make the switch.

Ready to ditch fees forever? Open your fee-free checking account in minutes here and join millions of smart savers who've reclaimed their financial freedom!