Affiliate Disclosure: This post may contain affiliate links, meaning we may earn a commission at no extra cost to you if you purchase through our links.

When it comes to money, every stage of life presents its own challenges. That’s why understanding the 50 financial mistakes to avoid at every age is key to building a secure financial future. Whether you’re in your 20s, 40s, or heading into retirement, making smart money choices now can prevent headaches later.

Financial Mistakes to Avoid in Your 20s

Your 20s are often about newfound independence, but money missteps here can ripple into the future.

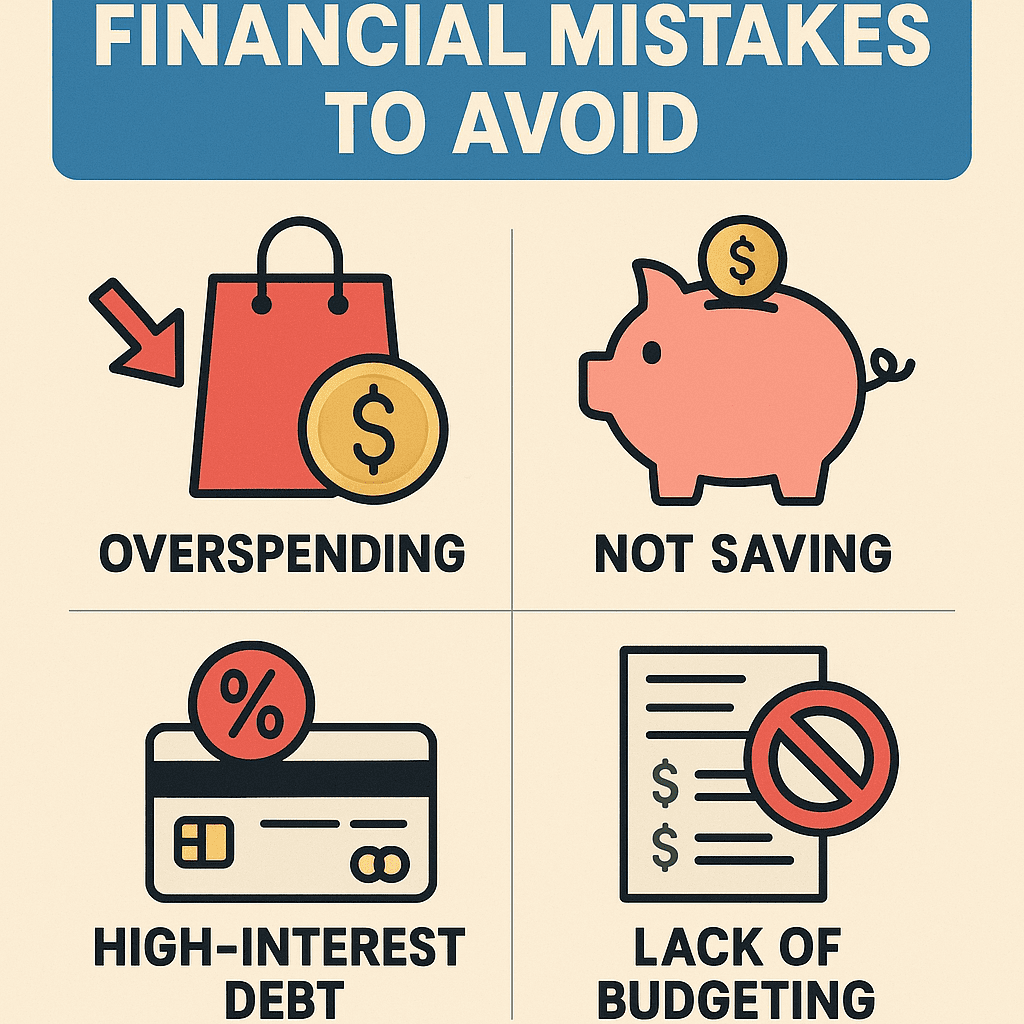

1. Ignoring Budgeting

Not tracking income and expenses often leads to overspending. A simple budget app can help you stay on track.

2. Accumulating High-Interest Debt

Credit cards can be tempting, but revolving balances at high interest rates can snowball fast.

- Set up automatic payments.

- Pay more than the minimum balance.

- Use credit responsibly to build your score.

3. Not Starting to Invest Early

Time is your greatest asset. Even small contributions to a retirement account can grow significantly through compounding.

Financial Mistakes to Avoid in Your 30s

As responsibilities increase—like a mortgage or family—so does the need for stronger financial planning.

4. Lifestyle Inflation

As income rises, it’s tempting to spend more. Instead, maintain modest expenses and invest the difference.

5. Skipping Emergency Savings

Unexpected expenses can derail your finances. Aim for at least 3–6 months of living expenses in a liquid account.

| With Emergency Fund | Without Emergency Fund |

|---|---|

| Peace of mind during crises | Reliance on credit cards |

| Less financial stress | High-interest debt risk |

Financial Mistakes to Avoid in Your 40s

This decade is crucial for catching up on retirement and balancing family obligations.

6. Underestimating Retirement Needs

Relying solely on social security or employer plans may not be enough. Calculate your projected expenses early.

7. Neglecting Insurance Coverage

Disability, life, and health insurance are essential to protect your family’s financial future.

Financial Mistakes to Avoid in Your 50s and Beyond

These years are about preparation for retirement and ensuring your wealth is preserved.

8. Tapping Retirement Accounts Too Soon

Early withdrawals can result in penalties and missed growth opportunities. Keep funds invested whenever possible.

9. Not Having a Will or Estate Plan

Without proper estate planning, your assets may not be distributed according to your wishes.

FAQs on Financial Mistakes

1. What is the biggest financial mistake young adults make?

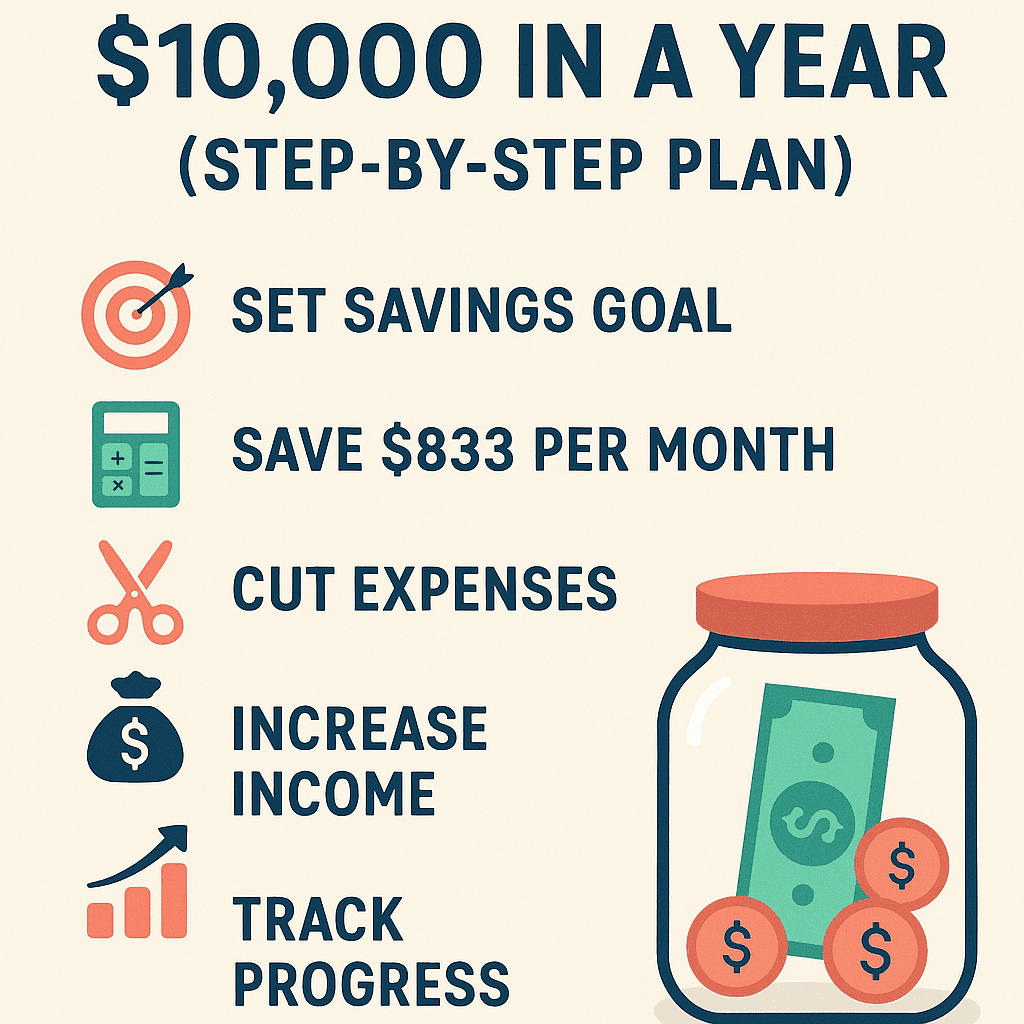

Most often, it’s delaying saving and investing. The earlier you start, the more time your money has to grow.

2. How much should I save for emergencies?

Experts recommend 3–6 months of living expenses, depending on job stability and family needs.

3. Is debt always bad?

No, not all debt is bad. Strategic debt, like a mortgage with low interest, can build wealth over time.

4. When should I start planning for retirement?

The best time is now—no matter your age. Even small contributions make a big difference long term.

Conclusion

Avoiding these 50 financial mistakes to avoid at every age can help you secure financial freedom and peace of mind. Remember, smart money choices now lead to greater opportunities tomorrow.

👉 Ready to take charge of your finances? Check out our recommended financial tools here: Get Started Today