Disclosure: This post contains affiliate links, meaning I may earn a commission if you make a purchase through my links, at no extra cost to you.

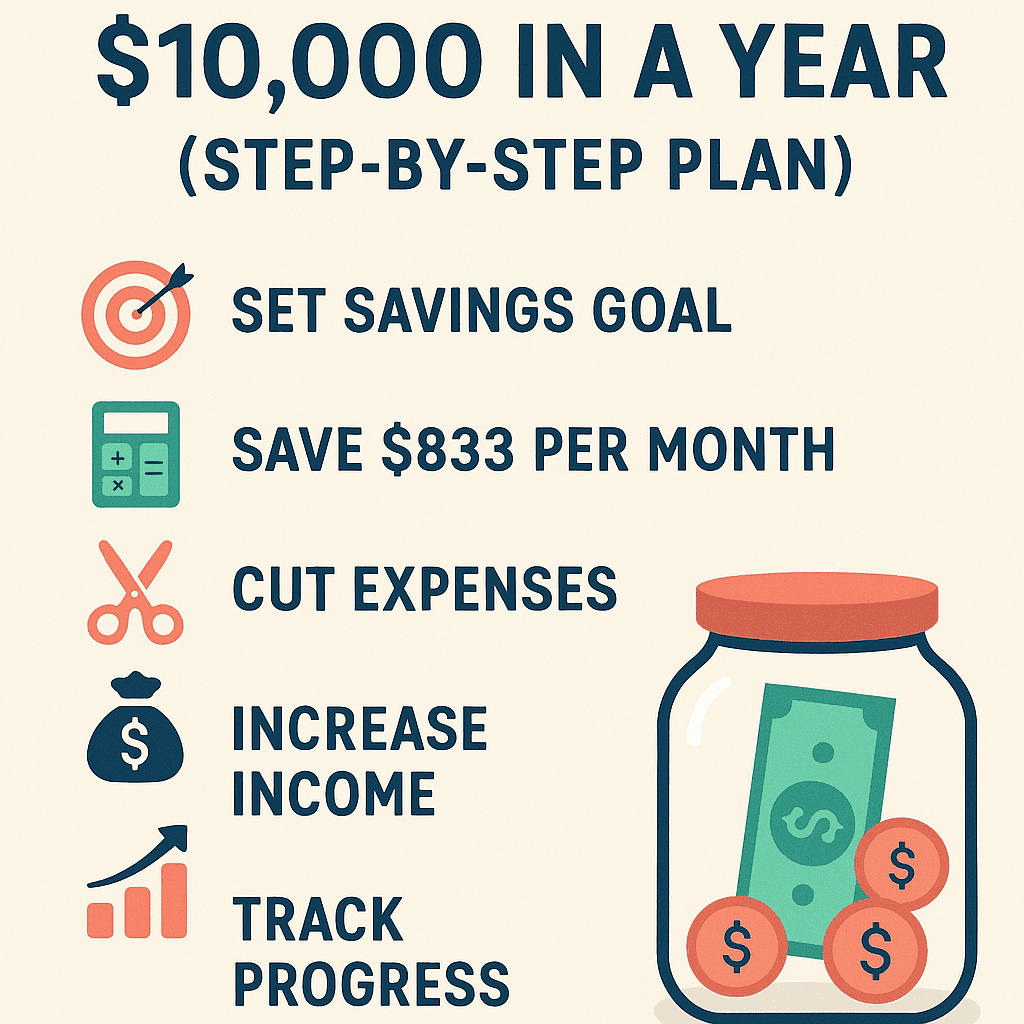

Saving $10,000 in a year might sound ambitious, but with a clear strategy and consistent effort, it's absolutely achievable. This step-by-step plan breaks down exactly how to save $10,000 in 12 months through practical budgeting, smart spending cuts, and income-boosting tactics. Whether you're building an emergency fund, saving for a down payment, or just want financial security, this guide will transform your savings game.

Why Saving $10,000 Matters (And How We'll Get There)

Before diving into the tactics, let's acknowledge why this goal is worth pursuing. $10,000 can:

- Cover 3-6 months of living expenses for most households

- Fund a significant life goal (travel, education, home renovation)

- Provide peace of mind during financial emergencies

- Kickstart your investment journey

Our approach focuses on three pillars: tracking, optimizing, and automating. By the end of this guide, you'll have a personalized roadmap to hit $10,000 without extreme deprivation.

Step 1: Master Your Money Foundation

You can't improve what you don't measure. This phase is about understanding your cash flow so we can identify savings opportunities.

Track Every Dollar for 30 Days

Use a budgeting app (like YNAB or Mint) or simple spreadsheet to log:

- All income sources (salary, side gigs, investments)

- Fixed expenses (rent, utilities, loan payments)

- Variable spending (groceries, dining out, entertainment)

Pro Tip: Categorize expenses as “needs” (50%), “wants” (30%), and “savings/debt” (20%) using the 50/30/20 budget framework.

Conduct a Spending Audit

After 30 days, analyze your data:

- Identify your top 3 spending leaks (e.g., $200/month on takeout coffee)

- Highlight subscriptions you rarely use

- Note seasonal expenses (holidays, car maintenance) to plan for

This audit reveals where your money actually goes versus where you think it goes. Most people are shocked by at least one category!

Step 2: Implement Aggressive (But Sustainable) Savings Tactics

Now we'll optimize your finances to free up $834/month ($10,000 ÷ 12). Here's how to find that money without sacrificing your quality of life.

Slash Fixed Expenses (Biggest Impact)

Target recurring bills first – small monthly cuts compound massively:

| Expense | Monthly Savings | Annual Savings |

|---|---|---|

| Refinance student loans | $150 | $1,800 |

| Negotiate internet/cable | $50 | $600 |

| Switch cell phone plan | $40 | $480 |

| Refinance auto loan | $75 | $900 |

Total potential: $315/month ($3,780/year)

Optimize Variable Spending

Trim discretionary expenses with these painless swaps:

- Groceries: Meal plan, use cashback apps like Ibotta, and shop at discount stores. Save: $150/month

- Dining: Cook at home 4x/week instead of ordering out. Save: $120/month

- Entertainment: Replace 2 movie nights/month with library rentals or free community events. Save: $50/month

- Shopping: Implement a 30-day “cooling off” period for non-essential purchases. Save: $100/month

Total potential: $420/month ($5,040/year)

Boost Your Income (Accelerate Progress)

Earning more gives you faster results without extreme frugality:

- Sell unused items: List clothes, electronics, or furniture on eBay/Facebook Marketplace. Potential: $200/month

- Side hustles: Freelance on platforms like Upwork or drive for Uber/Lyft. Potential: $300/month

- Ask for a raise: Document achievements and request a 5-10% salary increase. Potential: $200+/month

Total potential: $700+/month ($8,400+/year)

Step 3: Automate and Protect Your Savings

Automation makes saving effortless and prevents “accidental” spending.

Set Up Automatic Transfers

On payday, automatically move $834 to:

- A high-yield savings account (HYSA) like Ally or Marcus (currently earning 4-5% APY)

- Separate sub-accounts for specific goals (e.g., “Emergency Fund,” “Vacation”)

Key tactic: Treat savings like a non-negotiable bill. Pay yourself first!

Build Barriers Against Temptation

Make your savings hard to access:

- Use an online-only bank with no ATM/debit card access

- Set withdrawal limits on your savings account

- Name accounts descriptively (e.g., “DO NOT TOUCH – House Fund”)

Psychology tip: Labeling accounts with specific goals reduces temptation to dip into savings by 30%.

Step 4: Track Progress and Celebrate Milestones

Monthly check-ins keep you motivated and allow course corrections.

- Review your budget: Compare actual vs. planned spending

- Check savings growth: Celebrate every $1,000 milestone!

- Adjust as needed: If you overspend one month, compensate the next

Free tracking tool: Use Google Sheets with formulas to project your savings date based on current progress.

Frequently Asked Questions

Q: What if I have irregular income?

A: Base your savings target on your lowest-earning month. During high-income months, save aggressively to build a buffer.

Q: How do I stay motivated when progress feels slow?

A: Use visual trackers like a savings thermometer chart. Also, share your goal with an accountability partner for encouragement.

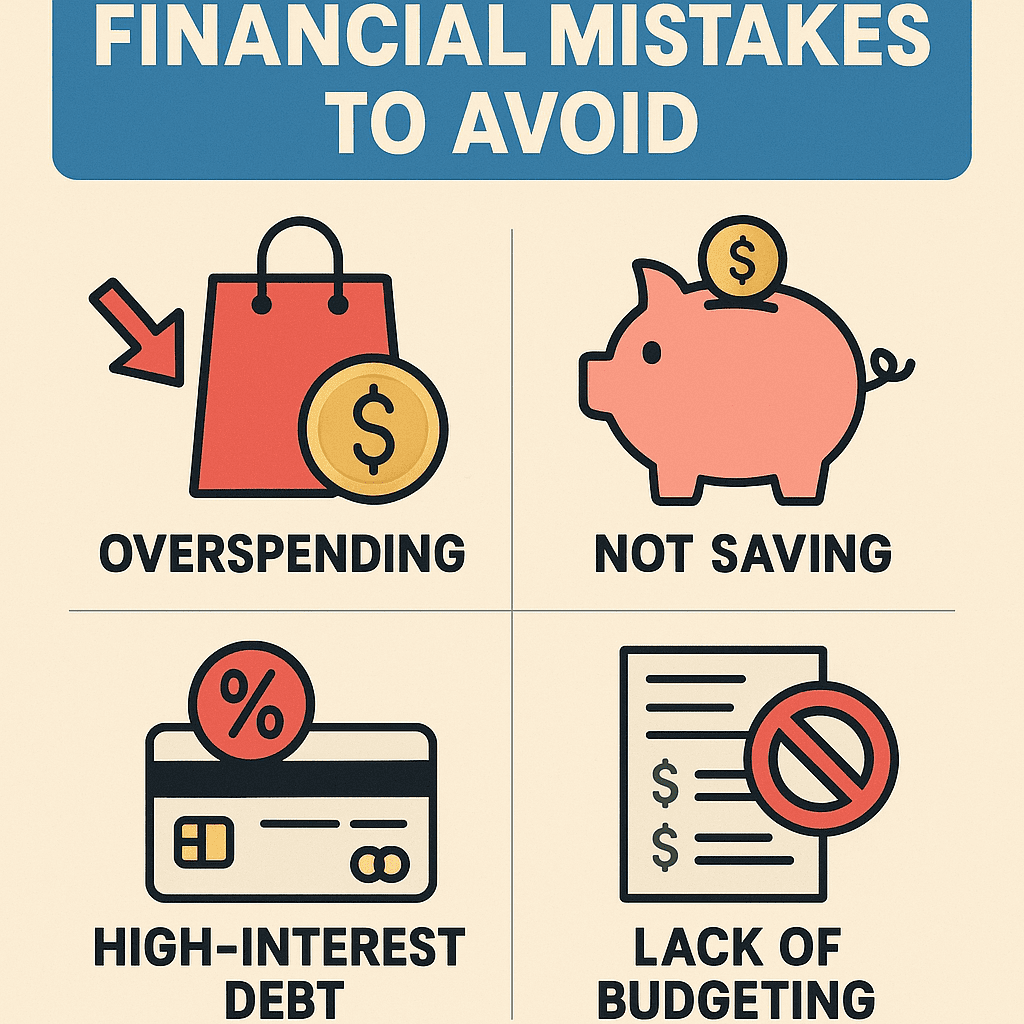

Q: Can I still save $10,000 if I'm in debt?

A: Yes! Focus on high-interest debt first (credit cards), then allocate savings toward lower-interest debt while building a small emergency fund.

Q: What if I have an emergency and need to use the savings?

A: That's exactly why you're saving! Replenish the fund by temporarily increasing your savings rate once the emergency passes.

Conclusion: Your $10,000 Savings Journey Starts Now

Saving $10,000 in a year isn't about perfection – it's about progress. By tracking your spending, optimizing expenses, boosting income, and automating savings, you'll build life-changing financial momentum. Remember: every dollar saved today buys you freedom tomorrow.

Ready to transform your finances? Start with Step 1 today: download a free budget template and track your spending for 30 days. For personalized tools to accelerate your progress, check out my recommended budgeting app bundle with exclusive discounts for readers.