How to Avoid Lifestyle Inflation: 7 Proven Strategies

Disclosure: This post contains affiliate links, meaning I may earn a commission if you make a purchase through my links, at no extra cost to you.

Ever wonder why your salary doubled but your savings didn't? You're likely experiencing lifestyle inflation – that sneaky phenomenon where expenses rise to match income increases. Learning how to avoid lifestyle inflation is crucial for building real wealth. In this guide, we'll explore why it happens and share actionable strategies to keep your spending in check while enjoying life's upgrades mindfully.

What Is Lifestyle Inflation and Why Does It Happen?

Lifestyle inflation occurs when increased income leads to disproportionate spending increases. It's that subtle shift from “I can finally afford this” to “I deserve this” without financial planning. While treating yourself occasionally is healthy, unchecked lifestyle inflation can sabotage long-term financial goals.

The Psychology Behind Spending More

Our brains are wired to adapt quickly to new circumstances. When you get a raise or bonus, the initial excitement fades fast. To maintain that happiness boost, we often seek new purchases or experiences. This “hedonic adaptation” makes lifestyle inflation feel natural – even necessary.

Common Triggers of Lifestyle Inflation

Watch out for these catalysts that silently inflate your lifestyle:

- Salary increases or promotions

- Receiving bonuses or tax refunds

- Moving to a higher-paying job

- Payoff of significant debt

- Social pressure from peers' spending

The Hidden Costs of Lifestyle Inflation

Beyond obvious spending increases, lifestyle inflation carries hidden penalties that compound over time. Understanding these consequences can motivate healthier financial habits.

Impact on Financial Goals

Every dollar absorbed by lifestyle inflation is a dollar not working for your future. Consider these opportunity costs:

- Delayed retirement savings

- Reduced investment growth potential

- Slower debt elimination progress

- Weaker emergency fund position

Long-Term Consequences

The most dangerous aspect of lifestyle inflation is how it normalizes higher spending. What starts as occasional upgrades becomes permanent baseline expenses, creating financial fragility when income decreases or unexpected costs arise.

7 Practical Ways to Avoid Lifestyle Inflation

Breaking the lifestyle inflation cycle requires intentional strategies. Here are proven methods to maintain financial discipline while enjoying your hard-earned money:

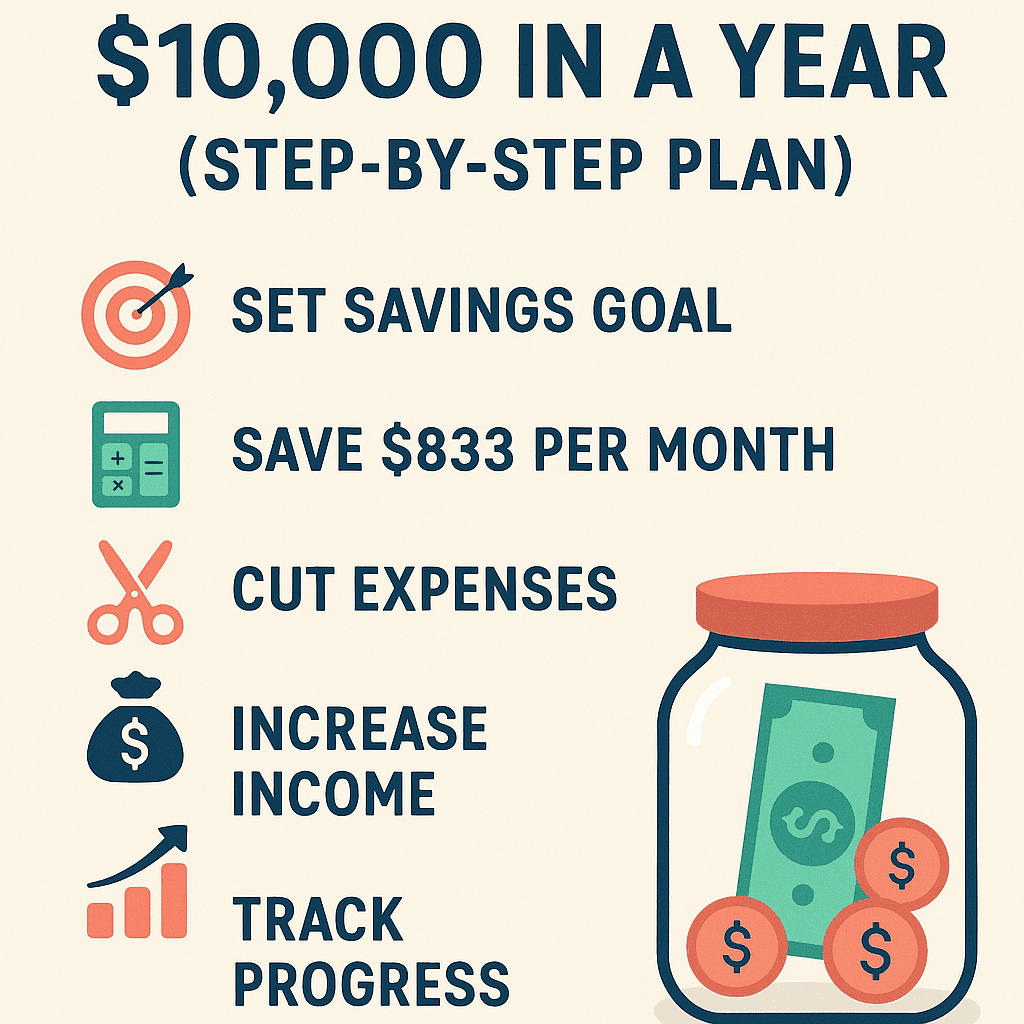

1. Set Clear Financial Goals

Before spending increases, define what financial success means to you. Specific goals like “save $10,000 for a house down payment” or “max out retirement accounts” create natural spending guardrails. Review these goals quarterly to stay accountable.

2. Automate Your Savings

Pay yourself first by automating savings transfers whenever income increases. If you get a 5% raise, immediately redirect 3% to savings/investments. This “out of sight, out of mind” approach prevents lifestyle creep while building wealth.

3. Practice Mindful Spending

Implement the 24-hour rule for non-essential purchases over $100. Ask yourself:

- Does this align with my values?

- Will I still value this in 6 months?

- Could I rent/borrow instead?

4. Delay Gratification

When income increases, wait 3-6 months before adjusting lifestyle. This pause helps distinguish between true needs and temporary wants. During this period, save the difference and evaluate what upgrades genuinely improve your life quality.

5. Review Subscriptions Regularly

Lifestyle inflation often hides in recurring charges. Audit subscriptions quarterly using apps like Mint or Truebill. Cancel unused services and negotiate better rates for essentials. Challenge each subscription: “Would I buy this today at full price?”

6. Increase Savings with Raises

Adopt the “50/50 rule” for windfalls: Save 50% and use 50% for meaningful upgrades. This balances enjoyment with progress. For regular raises, save at least half the increase before adjusting spending.

7. Surround Yourself with Frugal Friends

Social environments heavily influence spending habits. Cultivate relationships with people who value financial independence. Their perspectives will normalize saving and make lifestyle inflation feel less inevitable.

Lifestyle Inflation vs. Healthy Spending: Finding the Balance

Avoiding lifestyle inflation doesn't mean living like a monk. The key is distinguishing between mindless consumption and intentional upgrades that genuinely improve your life.

| Lifestyle Inflation | Healthy Spending |

|---|---|

| Impulsive purchases to impress others | Planned upgrades aligned with values |

| Spending entire raise immediately | Increasing savings rate with income growth |

| Keeping up with peers' consumption | Making independent financial decisions |

| Neglecting long-term goals | Balancing present enjoyment with future security |

Frequently Asked Questions

Is all lifestyle inflation bad?

Not necessarily. Controlled lifestyle inflation that aligns with your values and financial plan can be healthy. The danger occurs when spending increases automatically with income without conscious decision-making.

How much should I save when my income increases?

Financial experts recommend saving at least 50% of any raise or windfall. For significant income jumps (20%+), consider saving 70-80% initially while adjusting to the new financial reality.

What if I'm already experiencing lifestyle inflation?

Start by tracking all expenses for 30 days. Identify areas where spending has crept up unnecessarily. Implement a “spending freeze” for 30 days on non-essentials, then gradually reintroduce expenses mindfully.

Can lifestyle inflation ever be beneficial?

Yes, when it represents strategic investments in your well-being. Examples include spending on education that increases earning potential, health improvements that prevent future costs, or time-saving services that enable more productive work.

Conclusion: Take Control of Your Financial Future

Mastering how to avoid lifestyle inflation isn't about deprivation – it's about conscious choices that align spending with your true values and goals. By implementing these strategies, you'll build wealth while enjoying meaningful upgrades that genuinely enhance your life. Ready to transform your relationship with money? Discover budgeting tools that make avoiding lifestyle inflation effortless here. Your future self will thank you for the financial freedom you create today.