Emergency Fund: How Much Do You Really Need?

Disclosure: This post contains affiliate links, meaning I may earn a commission if you make a purchase through my links, at no extra cost to you.

Building an emergency fund is one of the most critical steps toward financial security. But when it comes to the actual savings target, the question “how much do you really need?” can feel overwhelming. The truth is, there's no universal magic number—your ideal emergency fund depends entirely on your unique circumstances. In this guide, we'll break down the factors that determine your target savings, debunk common myths, and give you actionable steps to build your financial safety net.

What Exactly Is an Emergency Fund?

Before diving into numbers, let's clarify what we're talking about. An emergency fund is cash set aside specifically for unexpected, urgent expenses—think job loss, medical emergencies, urgent home repairs, or sudden car breakdowns. This isn't vacation money or a new gadget fund; it's your financial life preserver.

The Core Purpose of Your Safety Net

Your emergency fund serves three non-negotiable purposes:

- Prevents debt during crises

- Reduces financial stress

- Provides decision-making freedom (like leaving a toxic job)

Why “Just Enough” Beats “Too Much”

While saving more feels safer, hoarding excessive cash has drawbacks. Money sitting in a low-yield account loses purchasing power to inflation. The goal is optimal protection—not maximal cash stagnation.

The 3-6 Month Rule: Myth vs. Reality

You've probably heard the standard advice: “save 3-6 months of expenses.” But this oversimplified guideline ignores crucial variables. Let's dissect when this works—and when it doesn't.

When 3 Months Might Suffice

A lean 3-month fund could work if you:

- Have a stable, in-demand job

- Are single with no dependents

- Carry minimal debt

- Have strong social support systems

- Live in an area with low unemployment

When You Need 6+ Months

Consider 6+ months of expenses if you:

- Are self-employed or work in a volatile industry

- Support a family or aging parents

- Have chronic health issues

- Own an older home or car

- Live in a high-cost area

Key Factors That Determine YOUR Target

Your ideal emergency fund size depends on these personalized factors:

Income Stability & Job Market

Freelancers, gig workers, and sales professionals should aim for 6-12 months. Tenured teachers or government employees might need only 3-4 months. Research your industry's average unemployment duration.

Dependents & Fixed Obligations

Each dependent (child, elderly parent) typically adds 1-2 months to your target. Also factor in non-negotiables like mortgages, insurance premiums, and student loans.

Health & Insurance Gaps

High-deductible health plans or lack of disability insurance warrant a larger fund. Even with insurance, out-of-pocket medical costs average $1,300 per emergency room visit.

Home & Transportation Risks

Older homes need 1-2% of their value annually for repairs. Cars over 5 years old should have $1,000-$2,000 earmarked specifically for breakdowns.

| Life Situation | Recommended Fund Size |

|---|---|

| Single renter, stable job | 3 months |

| Married with kids, dual income | 4-5 months |

| Single parent, freelance work | 8-12 months |

| Retired with fixed income | 2-3 years |

Building Your Emergency Fund: Action Plan

Now that you know your target, here's how to get there without overwhelm:

Step 1: Calculate Your True Expenses

Track spending for 30 days. Include EVERYTHING: rent, groceries, utilities, insurance, minimum debt payments, and modest lifestyle costs. Multiply by your target months.

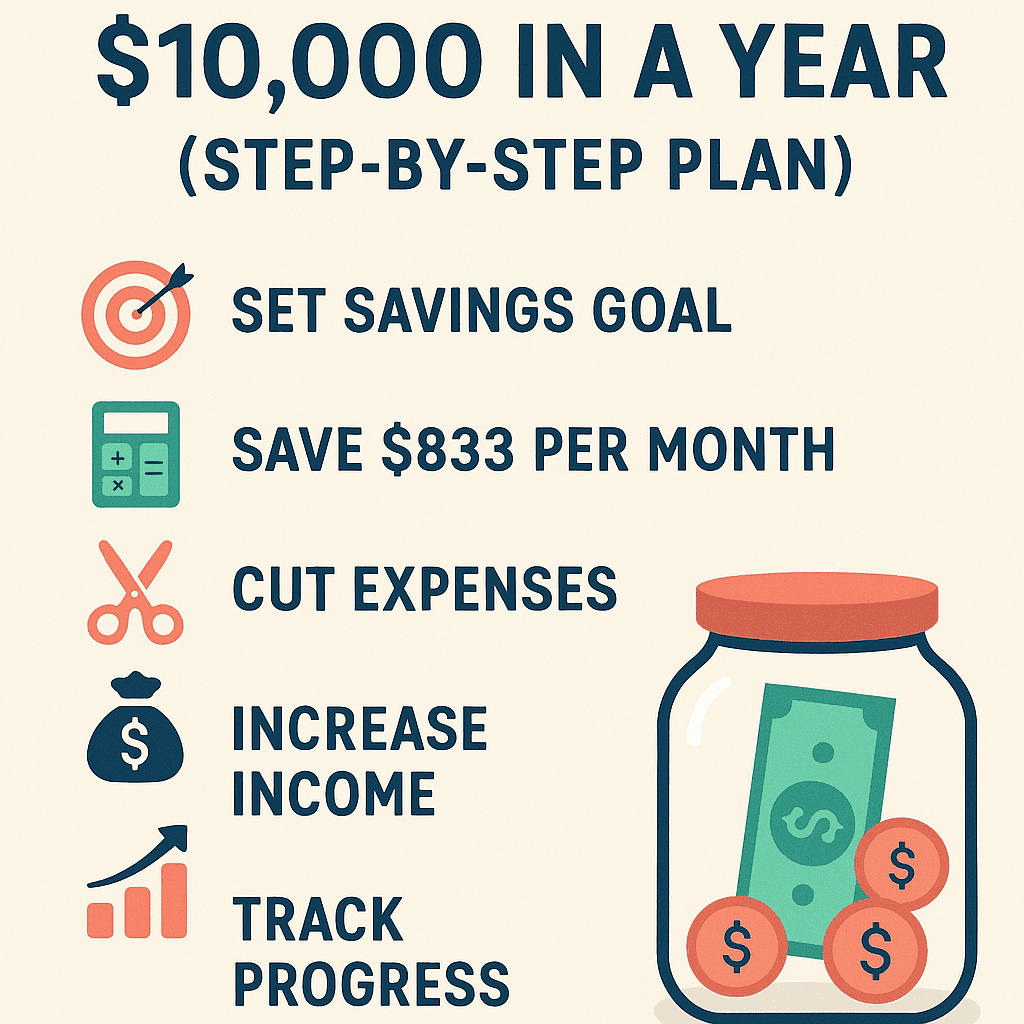

Step 2: Start Small & Automate

Begin with $500-$1,000 for micro-emergencies. Then automate transfers: “Pay yourself first” with each paycheck. Even $20/week builds $1,040/year.

Step 3: Optimize Your Storage

Keep funds liquid but separate from daily accounts. High-yield savings accounts currently earn 4-5% APY—far better than traditional savings. Avoid investments where you can't access cash immediately.

Frequently Asked Questions

Can I have too much in an emergency fund?

Yes. Once you exceed 12 months of expenses, consider allocating excess funds to retirement accounts or debt repayment. Cash loses value to inflation over time.

Should I pay off debt before saving?

Build a starter fund ($1,000) first, then prioritize high-interest debt (credit cards >7%). Simultaneously contribute to your emergency fund while tackling lower-interest debt.

What counts as an emergency?

True emergencies threaten your health, safety, or ability to earn income. Examples: urgent medical care, essential car repairs, job loss. Vacations, weddings, and non-urgent home upgrades don't qualify.

How do I rebuild after using my fund?

Resume contributions immediately, even if small. Temporarily reduce discretionary spending until you reach your target. Consider a side hustle for accelerated rebuilding.

Conclusion: Your Financial Peace of Mind Awaits

Building an emergency fund isn't about deprivation—it's about freedom. The right amount gives you confidence to handle life's surprises without derailing your financial goals. Start today, even if it's just $20. Your future self will thank you when the unexpected strikes. Ready to take control? Discover high-yield savings accounts that maximize your emergency fund growth here.